Are you struggling with managing your money & personal finances?

Are you using your money efficiently to create the life you dream of?

Are you able to plan money for the future of your loved ones?

Are your finances well planned to take the shock of any unexpected events?

ORAre you still stuck with the notion that you will do all this ONLY WHEN you have a lot of money?

"Have you wished to go from being confused, clueless or avoidant about managing your finances to being financially fit? What if you could get a simple approach that doesn’t stop at financial health but also makes it easy for you to create wealth? What if you could lay the foundation to achieve financial freedom & abundance, with no prior finance knowledge?"

But does thinking about Money management overwhelm you?

Money Overwhelm

We all have experienced money overwhelm at one moment or another, yet most people have not heard of it. Why is that? Many of us tend to hide our money overwhelm not only from others but also from ourselves and live in denial. Why? Because we surrender our power to money.

Do you find yourself in any of these situations?

- Can’t hold on to money, it continuously slips right through your fingers

- Anxious that if you lose your job then how will you & your family go on with life without getting majorly affected; Not prepared to deal with financial impact of unexpected emergencies

- Investment doesn’t come naturally to you, as you would rather keep money under mattresses and in secret places or at best in a FD

- Living in financial secrecy, fearing what others “think” of you

- Focused on getting higher return from investments or saving taxes, without bothering to have a plan about how that money will help you live the life that you desire

- Taking the ostrich approach and avoiding managing your money & taking financial decisions pretending this will not impact your life in any way

Even signs as common as these indicate Money Overwhelm.

The Problem Runs Deeper…

Let me also ask you this important question

“What is your relationship with money?”

Our relationship with money is a result of our subconsciously driven behaviours that, in most cases, we are not even aware of. Most of these behaviours have their roots in one’s childhood and get hardwired as patterns at early ages. They are so deeply ingrained in us, they determine how we deal with money as adults. When it comes to the relationship with money, people often have unconscious patterns, beliefs, and behaviours around money that block them from achieving their true financial potential. These challenges are fundamentally due to behavioural and emotional issues.

If you could relate to any of the situations listed above, then your overwhelm about money is real.

But I want you to know it’s not your fault.

Your decisions, actions & even inactions are a result of your subconsciously driven behaviours.

You may or may not be aware of the pain that your relationship with money is causing. This pain, whether or not in your conscious awareness, is not going to stop until you address it head on.

The lack of simple & unbiased guidance around skills to manage money adds to the problem….

Managing money & personal finances is an essential life skill required by each individual on a day-to-day basis. It is a skill that can be learned, but surprisingly no one teaches it. Please be clear I am not talking about managing some complex mathematical problem. I am talking about simply the basic skills to take the day-to- day decisions with your money in such a way that helps you achieve your dream life. In most cases we assume someone (either a parent, or spouse, or sibling or relative or someone else) will do it for us. There is not much unbiased support or guidance available due to which people, who have no option of someone else managing their money, learn the long & hard way. Traditionally, it was either the LIC agent or a relative that most people would look too for guidance. On the flip side, now a days there’s information overload, with so much conflicting and/or outdated information that it results in NO ACTION.

The good news is that you have the power to change this by upgrading your money mindset & your money skillset.

The Solution

My unique approach in helping you become financially empowered

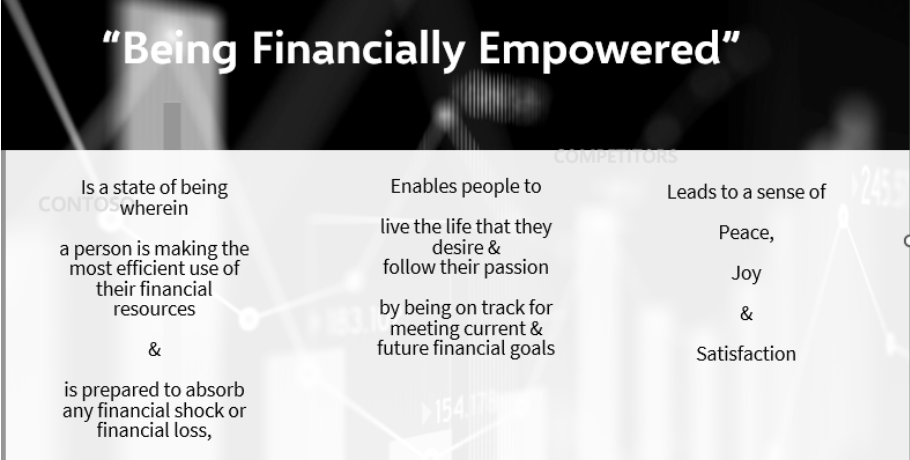

Become financially empowered and live your life to the fullest by taking control of your money & finances using a unique & simple approach created by me.

You are unique & every individual is unique. Your circumstances, preferences, values and the way you wish to live your life is unique to you. That’s why the objective of managing your money should be to enable you to use money as a tool to design your life in a way that's fulfilling & meaningful to you & in alignment with your values.

What does it mean to become Financially Empowered at mindset level & skill set level?

My Vision

Financial fitness becomes a way of life in the society and people no longer suffer due to lack of financial knowledge & limiting money beliefs.

Money conversations no longer are looked at as a taboo, instead they become part of every family's dinner table conversation, coffee table conversations among friends, colleagues & amongst everyone including children, regardless of their age, gender or any other factor.

My Mission

I am on a mission to empower people & families around the world to take control of their financial wellbeing. I help people go from being overwhelmed, confused, or clueless about managing their money & personal finances to being financially fit and having a good relationship with money. This in turn helps them achieve greater levels of personal satisfaction, prosperity, peace and fulfilment in their life.

How others have benefitted

How Kavita has impacted my relationship with money, leaves me lost for words. I soon learnt how my limiting beliefs impacted my money mindset, my daily habits and hampered my professional and personal growth. I can confidently say that I not only feel assured with my personal finances but now set audacious financial goals for myself that I work toward with defined steps and guidance, thanks to Kavita. Highly recommend this journey as it surely had a ripple effect on multiple domains of my life.

-Shreya, a digital media professional, Mumbai

I thought I knew exactly where I was in terms of inflow and outflow but this really helped put everything in perspective and how I wasn't aware of the true picture. Secondly assisting in setting a clear personal outcome to which I had previously never given thought. This will help me set realistic goals for myself that I would like to achieve for both myself and my family. I am very excited about the prospect of building a financially secure future with your guidance.

-Sumi, a business owner, Bangalore

It was a complete new perspective about money management. I could realise that financial health is basically different stages of a continuous journey. It resembled a specialist doctor treating a chronic patient.

-Akaash, Coach

Why me?

Who am I?

I have many different identities. I am an independent woman. I am a mother of a young daughter, I am a wife, a daughter, a sister, a daughter-in-law, a friend in terms of relationships. I have been a student, a young professional, I have been self-employed, I have also been in corporate jobs. I live in India. I have also experienced setting up my own house and living in London.

I have played many roles in my life and been through different life stages. I have understood very deeply & clearly that the way we look at money evolves with each life stage and each role that we play. Today I am who I am because I bring all these experiences along with me. Tomorrow, I will still be a better version of who I am today.

My Qualifications

- Chartered Accountant (CA)

- Certified Money Coach (CMC®) from The Money Coaching Institute in the USA which is the pioneer in the field of Behavioral Money Coaching globally. The only CMC® in India.

- Qualified Personal Finance Professional (QPFP®)

My career journey

A seasoned investment professional with close to two decades of experience in Financial Services industry.

I have a uniquely diverse & extensive background in Investments encompassing multiple areas including Investment Research, Analysis & Reporting, Investments Management, Investment Directing, Business Liaising, New Product development & launch, Investment Analytics.

I currently head the Investments Research & Analytics for the Indian operations of Guardian Life, a US based leading Insurance player. Prior to this, I have worked with organisations such as Fidelity International, Macquarie US, Moody’s, and Systematix Shares & Stocks, while being based out of Gurgaon, London & Mumbai. I have held varied Investments roles spanning across various asset classes (Equities, Private Equity, Credit, Multi-Asset) catering to institutional investors globally, and focused on various international markets & geographies. I have handled multi-site as well as cross functional teams and have worked closely with stakeholders across the globe. I have evolved through my diverse roles as an Investments Professional in the corporate world. I continue to thoroughly enjoy my corporate role & responsibilities, and aspire to be a better version of myself every single day.

My Money Story

I come from a marwari business family. As kids we were kept away from money conversations in the family during our growing up years.

I went on to become a Chartered Accountant and made a career as an Investments Professional and took on roles that deal with the sophisticated side of investments research & analysis, working with sophisticated institutional clients, portfolio managers etc.

My career has definitely been exciting and I have enjoyed moving from strength to strength in different investment roles. But I would see the contrast in the way people around me among my family & friends managed their money or the lack of information & guidance on this front. Was I any different? Well the truth is when it came to managing personal finances, I wasn't very different from the rest of them. Yes, that's true! No one teaches you how to manage your own money - It is not taught in schools, colleges or even professional courses such as CA or MBA. So as a finance professional with one or these degrees you may learn taxation, investments research, corporate finance; but personal finance is not even taught to finance professionals.

The only way I was different from the folks around me was when someone offered to sell some policies & financial products to me, I could do my own research, run some calculations in excel (sometimes even elaborate calculations) to analyse if it was a good offering or not. To my surprise when I ran the calculations, none of the so-called great products offered ever qualified to be good investments. So I definitely got saved from mis-selling But there's much more to managing your money than just that. I did work on other aspects as well, made some mistakes in the process, learnt from them and got some pieces of the personal finance jigsaw puzzle right. Even then I did not find a holistic end to end solution for years until there came a time when I said to myself that managing personal finances well and having a financially well planned life cannot be so difficult and I decided to make a conscious committed effort to decode it. This took me on a journey that most definitely has been a transformative & evolutionary process for myself. Today I have achieved Financial Freedom and have a much deeper understanding of money on psychological as well as practical levels.

My Passion Project – “The Money Coach (TMC)”

Over my long career in the Investments world, I saw the contrast where on one hand I worked with portfolio managers & sophisticated institutional investors across the globe; whereas on the other hand I saw that when it comes to managing own money & finances, most people really struggle and due to that their loved ones also suffer. I believe that they don’t deserve to or need to struggle but there is very little help available. I feel very strongly about filling this gap through increased education, awareness, and empowerment, so that people can be financially fit and are able to create a financially stress-free life for themselves and their loved ones. Being most ardent about making a difference on this front, I started my passion project “The Money Coach (TMC)” to fill this gap. My quest for decoding how to live a financially well planned & stress free life and helping people with the same has led me on a journey with many milestones.

- One of the most important aspects of this journey has been understanding the psychological aspects of managing money .

- I have worked on the theories of most renowned money gurus across the globe and filtered & imbibed their teachings to fit my unique approach

- I continue to learn & evolve on this front

After going into the depth of different aspects and pieces of the money management jigsaw puzzle, I have created a simple step by step approach that gives you just the right information you need to go from where you are to being financially fit and be on the path to financial freedom & abundance.

Committed to changing the way most people deal with, think about, and manage or rather mis-manage money.

The Money Coach

Become financially empowered and live your life to the fullest by taking control of your money & finances using a unique & simple approach created by me.